may 10, 2016 - Marina Now

The Boating Market in the Mediterranean - 2016, a year of recovery and changes

Europe offers the ideal environment for more than 48 million European boaters (Source Ricerca CNA sulle dinamiche e prospettive di mercato della filiera nautica del diporto terza edizione - 2014) to which number you also need to add all the non-EU nautical tourists. There are over 6 million recreational crafts stationed in European waters but just 4,500 marinas offering around 1.75 million berths between the open sea and inland waters (source CNA).

Despite these numbers, the berth market in recent years has suffered a heavy stagnation which finally ended in 2015 when the first signs of recovery could be seen: the seasonal berth requests have grown on average by 7.7% compared to 2014 and transit requests increased by 3.3% with a demand for berths coming mostly from motor boats (72%) rather than from sailboats (28%) (Marinanow surveys). But it doesn’t end here.

The marina market in general is experiencing a renewed growth, which can be seen in the quantity of new ports that are being built throughout the Mediterranean and consequently an increase in the number of berths with by far the largest concentration of Mediterranean transit trips taking place in the Tyrrhenian (70%) while the remaining 30% is distributed among all the other nautical quadrants. This improvement is due in part to the excellent climate conditions of the summer season, in part to the recovery in the market for used boats and partly to economic incentives that have been put in place by various governments to encourage a market that has historically been suppressed by taxes and bureaucracy.

One example of this is the reduced rate of VAT to 10% for "Marina Resorts", thanks to the “Legge di Stabilità” (Stability Law) from the Italian Government. A measure that allows marinas to be assimilated to resorts when they offer a range of services in the marina and has already led to a +4% growth in short-term moorings (source Osservatorio Nautico Nazionale 30 September 2015) despite the problems that there has been in applying the rule.

The crisis of this market though is far from over. First among the problems is the polarisation of the user bias. In recent years, we have seen on the one hand an increase in the number of megayacht owners - according to "Superyachtintelligence.com" in 2014 55% of the yachts chose a Mediterranean port as its home port - currently worth about 24 billion euro (source Superyachtintelligence.com report).

Although these remain very concentrated in the most famous resorts like Porto Cervo, Ibiza, Monte Carlo or Capri, with an average age of owners being over 50. It is in the western Mediterranean that there are a concentration of many of the marinas that can accommodate these types of boats.

On the other, the boats with the most transit voyages are those smaller than 12 metres with a prevalence towards motorboat over sailboats and attracting a younger age group (aged 18 to 50). The responses from a short survey carried out by Marinanow amongst their user base show that this tendency is even greater amongst those who are looking for a berth: 58% are looking for a berth under 12 metres while 36.4% are looking for one between 12 and 18 metres) and 45.5% are expecting to pay under €1000, and 27.3% between €1000 and €3000 and 27.3% are over €3000.

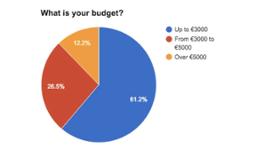

Although the gap is starting to dwindle among those renting boats: compared to 49% that prefer to hire a boat under 12 metres, 44.9% are looking for a boat between 12 and 18 metres with an expected budget in 61.2% of the cases estimated as below €3000; 26.5% would spend between €3000 and 5000 and 12.2% are thinking of spending over €5000.

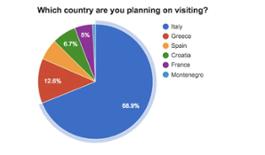

A sign that the crisis that had particularly hit this group of users (30-50 years), is showing signals of weakening (source: Marinanow) while there are signs of growing consumer confidence for this season with most users mostly choosing to visit the major Italian islands, from Sardinia to Sicily, Elba and Giglio, Ischia and Procida, Ponza and Ventotene, also with a trend towards Greece, Corsica, Croatia and Spain. A reversing trend? Certainly good news that bodes well for all market participants.

Another important point is regarding the digital switchover. The marina industry is still deeply bound to traditional systems. In all countries of the world boats entering a foreign port have to go through a long series of controls, with an often tiresome exchange with the local authorities of registration documents necessary to stay in territorial waters as well as onboard checks.

These tasks involve a considerable amount of time, effort and paper that with a digital switchover might be easily avoided. This attitude is also reflected in the approach to new digital platforms that enable online reservation: between those who seek online a boat or a boat site, the percentage of those who have already finalized a reservation online is around 35%.

With these findings in mind the project for the digitisation of marinas in the Mediterranean carried out by Marinanow together to Navigodigitale was launched in September with the ultimate goal of providing the ports of the Mediterranean a one stop solution for the digitisation of exchanges of documents needed for recreational vessels entering and exiting ports. The experiment hopes to produce some pretty impressive advantages: saving up to 80% of time wasted in processing documents, the elimination of about 2,000 sheets of paper from each office, greater traceability and the real-time control of progress of applications, the possibility for marinas to access an up to date database of all the demands and for users to make payments directly online.

Surely an important part of the "digital single market" which the European Union is trying so hard to use to break down language barriers, bureaucratic processes and local customs that hinder the free movement of goods and services. Even those by sea.

Italian

Italian  Share

Share Share via mail

Share via mail  Automotive

Automotive Sport

Sport Events

Events Art&Culture

Art&Culture Design

Design Fashion&Beauty

Fashion&Beauty Food&Hospitality

Food&Hospitality Technology

Technology Nautica

Nautica Racing

Racing Excellence

Excellence Corporate

Corporate OffBeat

OffBeat Green

Green Gift

Gift Pop

Pop Heritage

Heritage Entertainment

Entertainment Health & Wellness

Health & Wellness